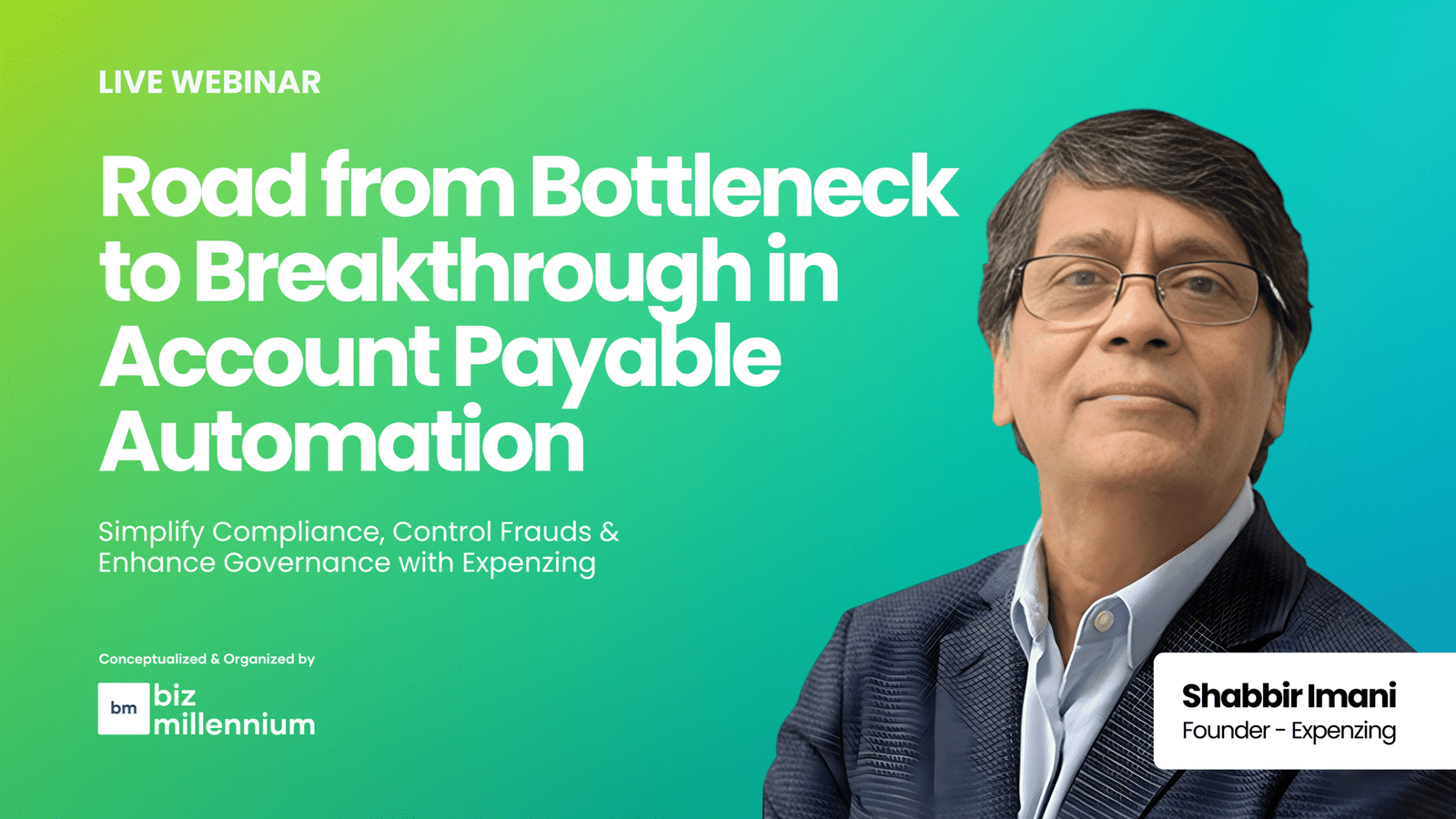

Road from Bottleneck to Breakthrough in Account Payable Automation

The Road to Fixing AP Compliance Gaps with Expenzing AP Automation Learning Outcomes📌 Spot Compliance Gaps Instantly: Learn how to quickly identify red flags and inefficiencies in your accounts payable process that could lead to compliance breaches.📌 Understand the Real Cost of Non-Compliance: Gain clarity on the regulatory, financial, and reputational risks tied to non-compliant […]

Road from Bottleneck to Breakthrough in Account Payable Automation Read More »