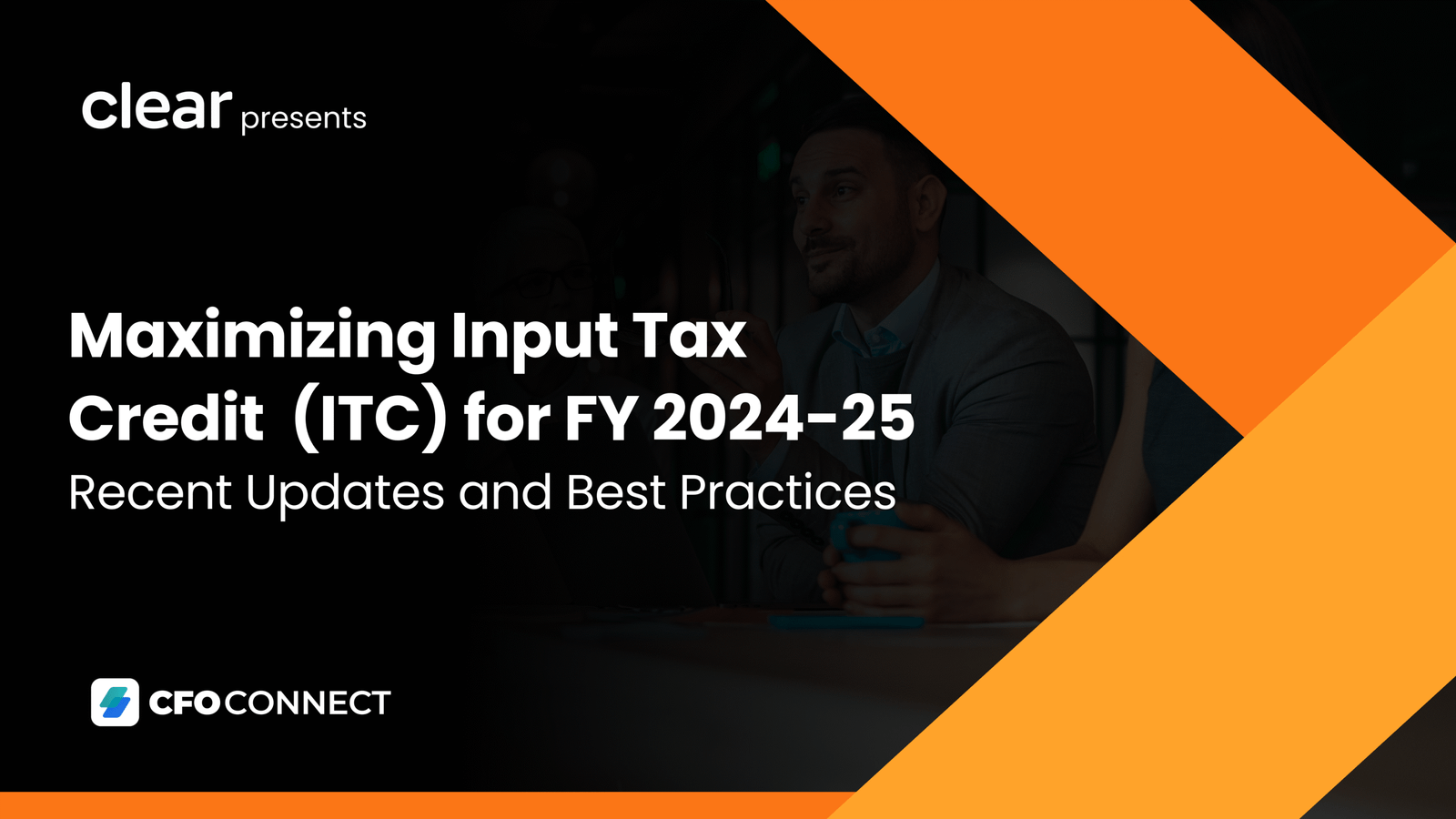

From Excel to AI

As India’s GST framework continues to evolve, enterprises are under growing pressure to reconcile Input Tax Credit (ITC) accurately and unlock working capital blocked by mismatches, delays, and outdated manual processes. Traditional reconciliation via Excel has become a major bottleneck—creating compliance risks, errors, and significant cash flow challenges. Team Clear invites you to an exclusive […]